Payroll data export

In order to export to DATEV or Lexware, employees need a personnel number. The personnel number can be defined in TimePunch for the relevant employees in the employee profile.

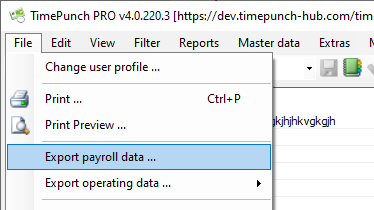

The export to DATEV or Lexware can be started via the menu "File / Export time entries".

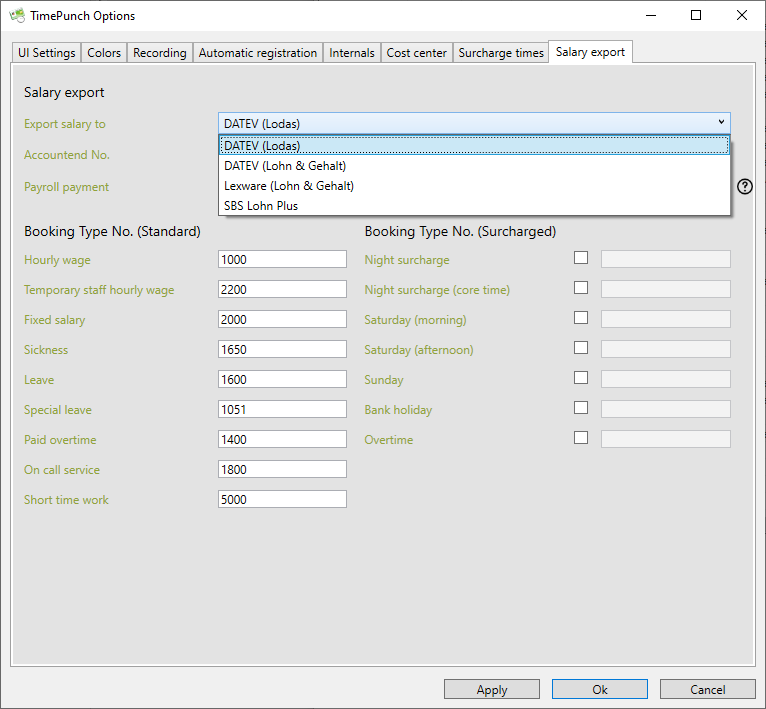

Depending on the export destination defined in the options, the export is performed for the following systems.

- DATEV (Lodas)

- DATEV (Lohn & Gehalt)

- Lexware (Lohn & Gehalt)

- SBS Lohn Plus

Data check

In order to be able to check the imported data, it is advisable to also provide the tax office with the "Payroll, Tabular" report for the month and all employees.

The wage data must always be checked before the wage is paid to the employee, as technical problems with the export and/or import to DATEV cannot be ruled out

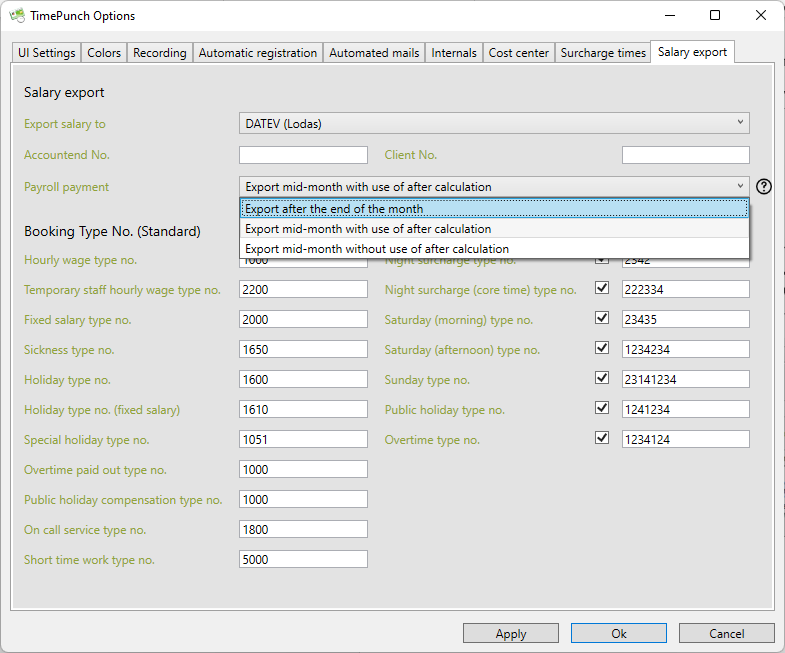

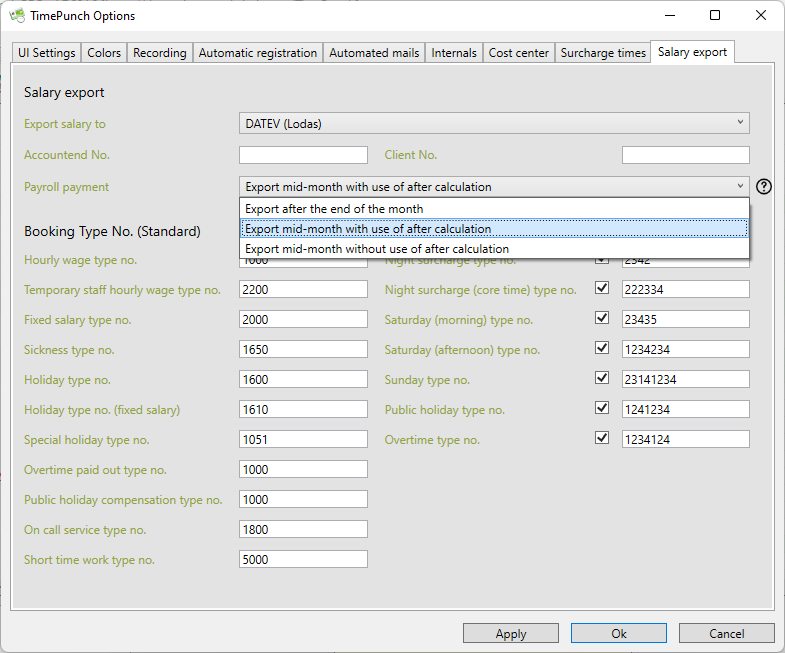

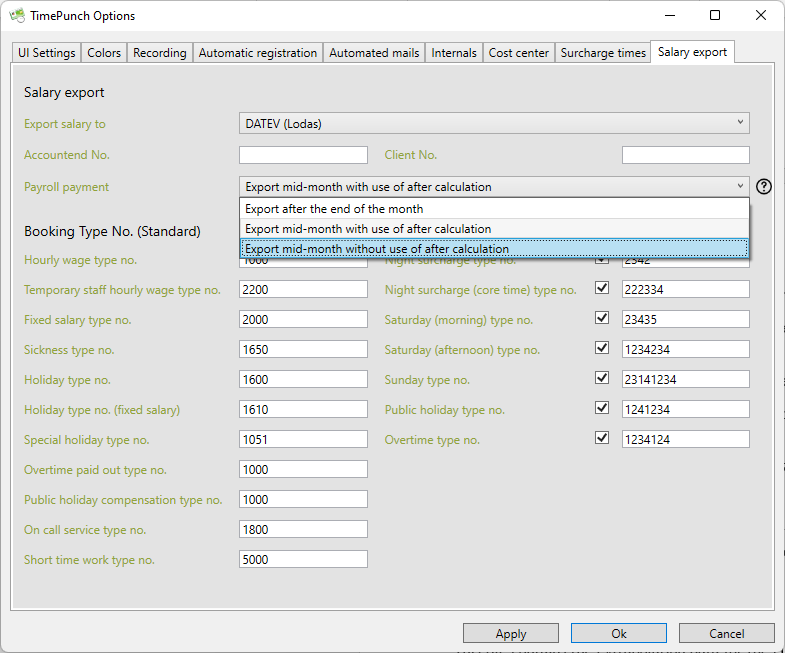

Salary payment

How the salary is paid is also important. Here you can choose between two options.

Export after the end of the month

With this method, the salary is only exported after the month is closed. This means that the employees receive the salary payment for the previous month in the middle of the following month. This is the simplest type of export, as no adjustment entries have to be made.

The following files are created:

DATEV{GROUP}{DATE}.TXT

This file contains all working times of the closed month for all employees.

**

**

Export in the middle of the month with use of recalculation

With this method, the wage data for the current month is exported on any key date (e.g. always the 20th). The data is used for wage payment.

After the month is closed, the previous month is exported again. TimePunch then exports the wage data as an adjustment entry.

On the due date, the extrapolation of the current month is exported again.

Important:

With this method, employees always receive the salary for the current month's projection, as well as a correction entry for the previous month.

The following files are created:

DATEVMNB{GROUP}_{DATE}_CALCULATION.TXT.

This file contains the extrapolation data for the current month.

DATEVMNB{GROUP}_{DATE}_RECALCULATION.TXT

This file is created when the previous month is exported in the following month. The file then contains the difference between the exported extrapolation and the actual bookings.

Export in the middle of the month without using recalculation

With this method, the wage data for the current month is exported on any key date (e.g. always the 20th). The data is used for wage payment.

At the end of the month, the previous month is exported again. TimePunch then exports the wage data as an adjustment entry for the current month.

On the key date, the current month's projection is then exported again.

Important:

The difference to the use with the recalculation is that the employee only receives one wage payment at a time. The adjustment posting is offset against the current month's projection.

The following files are created:

- FILEVONB{GROUP}_{DATE}_CALCULATION.TXT

This file contains the extrapolation data for the current month.

- DATEVONB{GROUP}_{DATE}_CORRECTION.TXT

This file is created when the previous month is exported in the following month. The file then contains the difference between the exported extrapolation and the actual bookings.

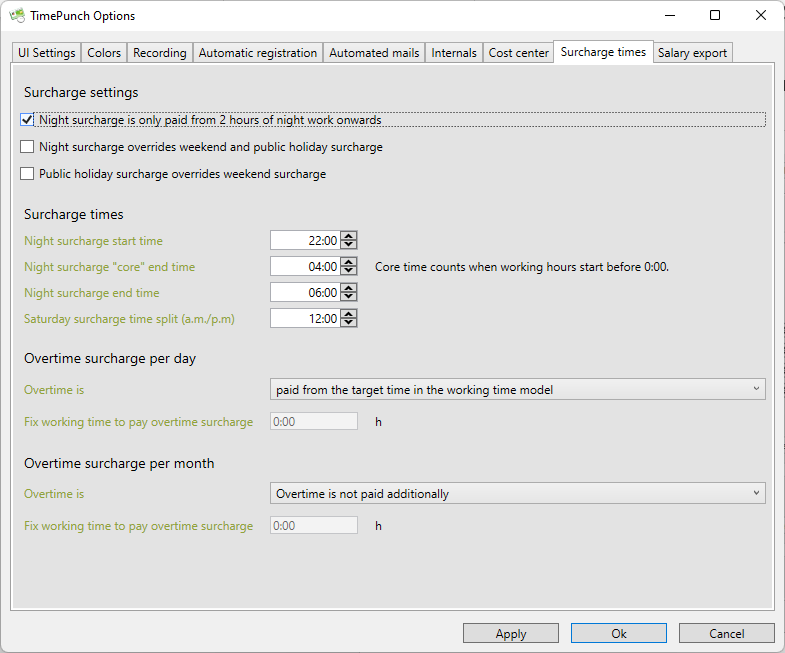

Surcharges and prioritisation

The surcharge-relevant times are set in the dialogue Extras / Options / Surcharge-relevant times.

Wage Surcharge Settings

The prioritisation of the individual supplement types can be set here.

Night bonus is only paid after 2 hours of night work

This setting ensures that employees only receive night bonus if they work for at least 2 hours at a time during the bonus-relevant time for the night bonus. This is provided for by law.

Night bonus overrides weekend and public holiday bonus

By law, only the payment of the night bonus is compulsory. Companies that only pay one type of supplement at weekends or on public holidays! Companies that want to pay only one type of supplement on weekends or public holidays must tick this box so that the night supplement is prioritised over weekend and public holiday supplements.

Holiday surcharge overwrites weekend surcharge

If a public holiday falls on a weekend, the two bonuses are added together. If this is not desired, the public holiday supplement can be prioritised over the weekend supplement.

Surcharge-relevant times

In this selection, the times relevant for the night and Saturday surcharge are defined.

Overtime bonus per day

This setting determines whether an overtime bonus per day is credited to the employee. An overtime bonus per day is effective immediately on the day on which the employee has worked longer than the target time or the set working time.

Therefore, the employee is paid overtime even if he or she has worked too little for the entire month.

Overtime premium per month

Overtime premium per month is only paid if the employee has worked more than his/her target time at the end of the month or if a total number of hours in the month is exceeded.

Overtime premiums per day and month can also be combined.

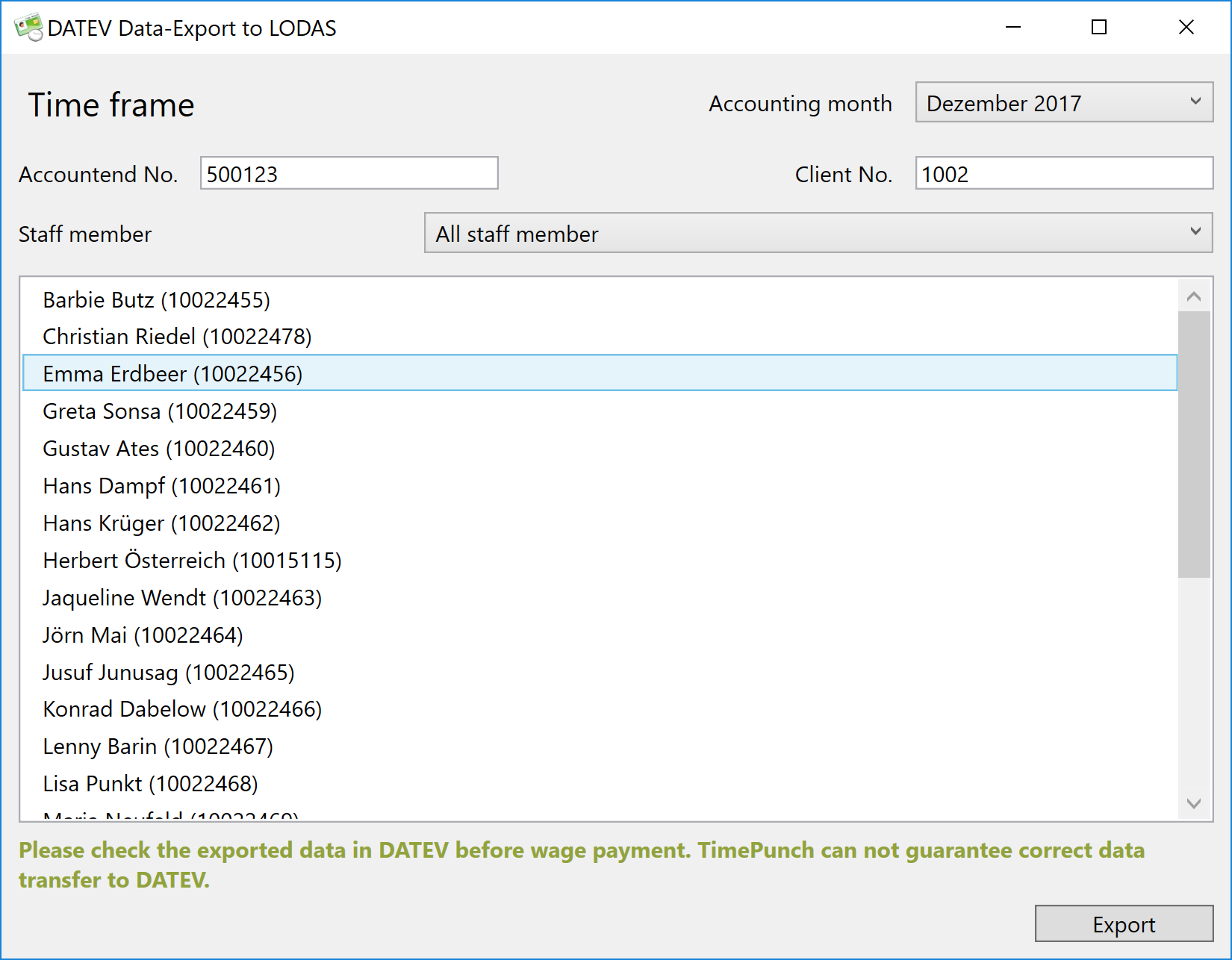

Export to DATEV LODAS

Important data that you need to export to DATEV:

Consultant number

The advisor number is assigned by DATEV for the tax advisor/tax office. If the consultant number is not known, it can be requested from the tax consultant or tax office.

Client number

The client number is your ID so that the time data can be assigned to your company.

Cost centers

Cost centers can be specified optionally for the different posting types. Please contact your tax office to clarify the need for this.

TimePunch supports export to DATEV in LODAS format. This format is used by most tax offices. After clicking "Export to DATEV (LODAS)" the following dialog opens:

The wage accounts used by the tax consultant are decisive for exporting to DATEV LODAS. In TimePunch, you can define a separate payroll account for each booking category (working time, overtime reduction, sick leave, and so on).

Export

By clicking on the "Export" button, a file dialog opens in which the storage location for the export can be selected.

The exported file can then be sent to the tax office by mail.

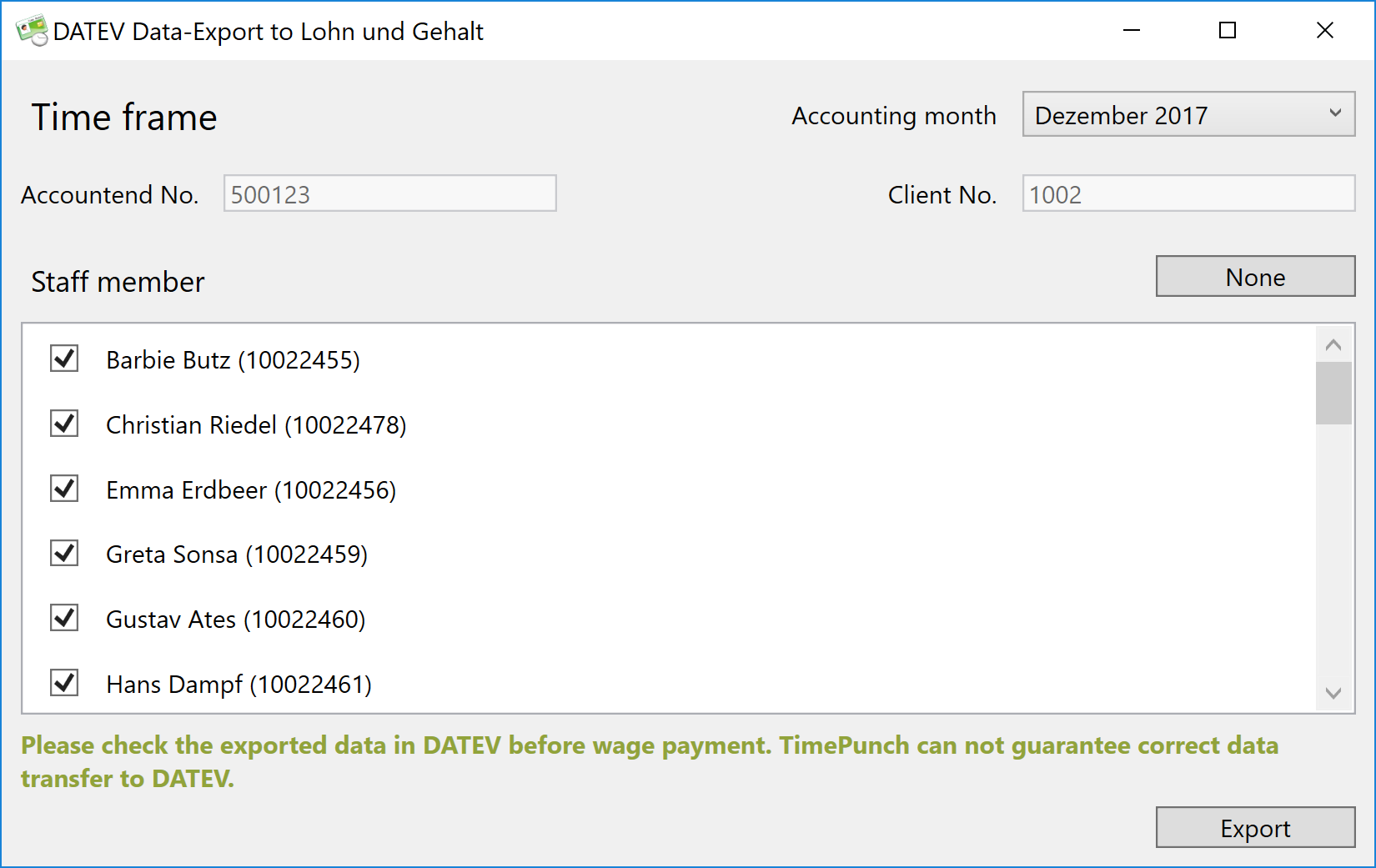

Export to DATEV (Lohn und Gehalt)

TimePunch supports export to DATEV in the format "DATEV Hourly Time Recording from v4.0".

The following dialog opens:

Export

By clicking on the "Export" button, a file dialog opens in which the storage location for the export can be selected.

The exported file can then be sent to the tax office by mail.

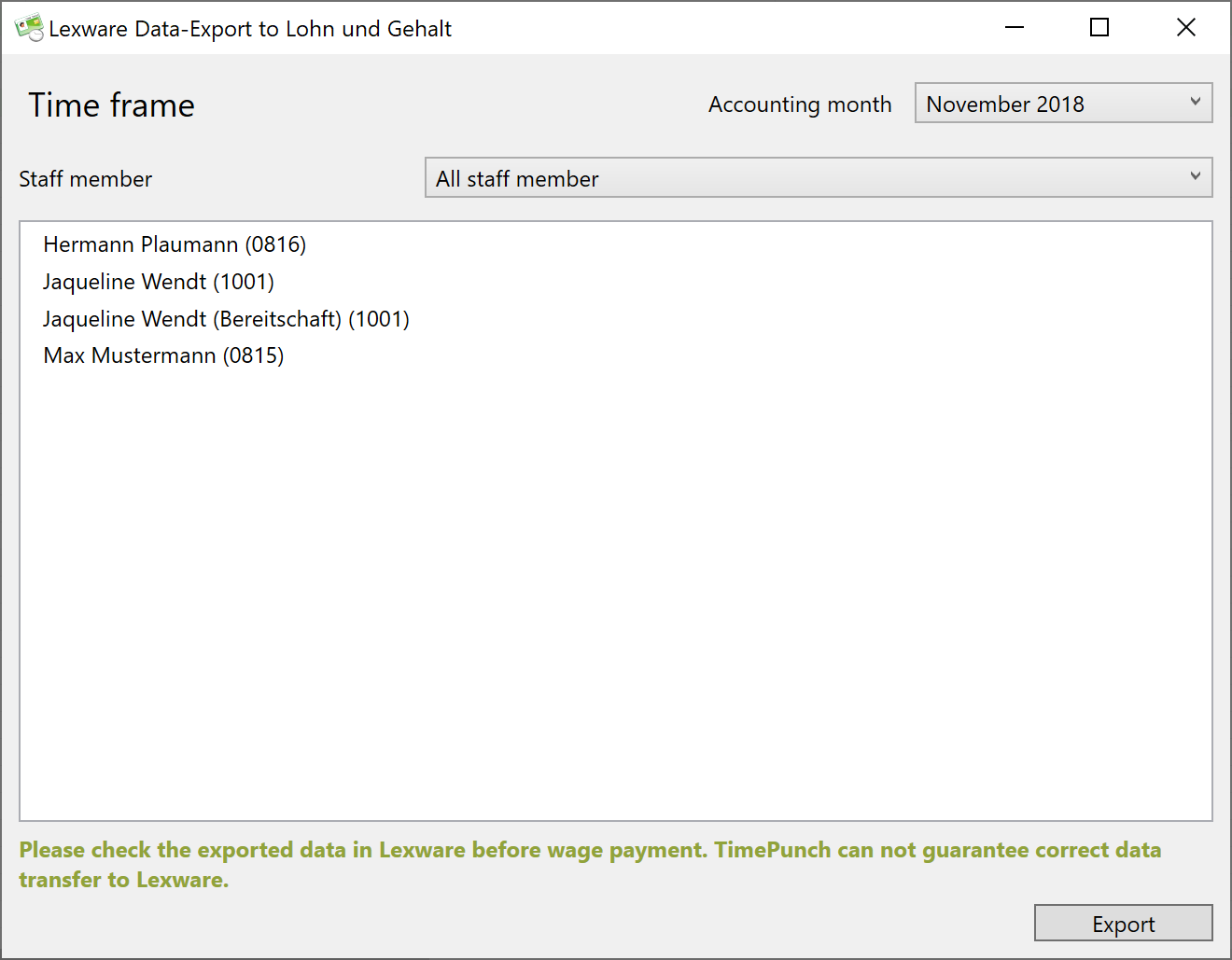

Export to Lexware Lohn und Gehalt

TimePunch also supports export to Lexware Lohn und Gehalt.

The following dialog opens:

Export

A click on the "Export" button opens a file dialog in which the storage location for the export can be selected.

The exported file can then be sent to the tax office by e-mail.

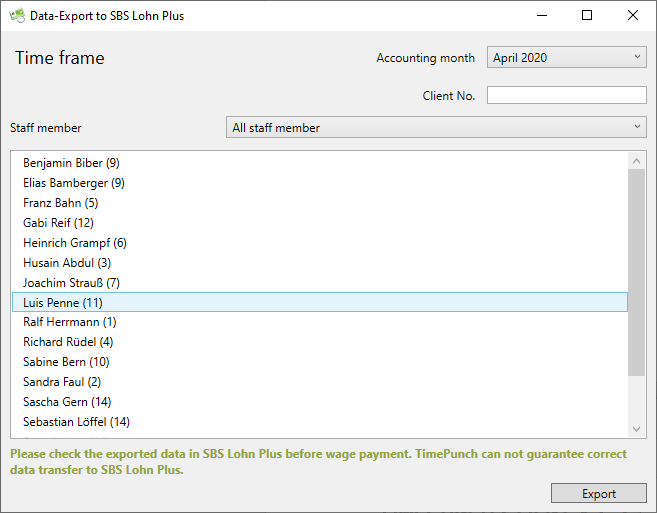

Export to SBS Lohn Plus

TimePunch supports the export to SBS Lohn Plus.

The following dialog opens:

Export

Clicking the "Export" button opens a file dialog in which the location for export can be selected.

The exported file can then be sent to the tax office by e-mail.

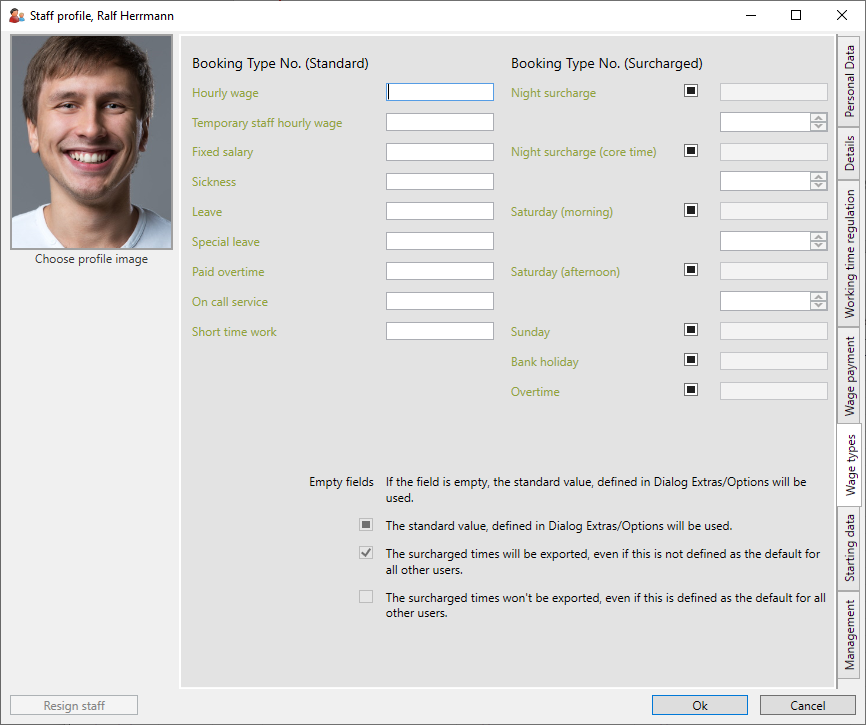

Define own wage types per employee

In TimePunch it is possible to overwrite the wage types for export per employee.

To do this, you must open the employee's profile and set the optional wage type in the "Wage payment" tab.

**

**

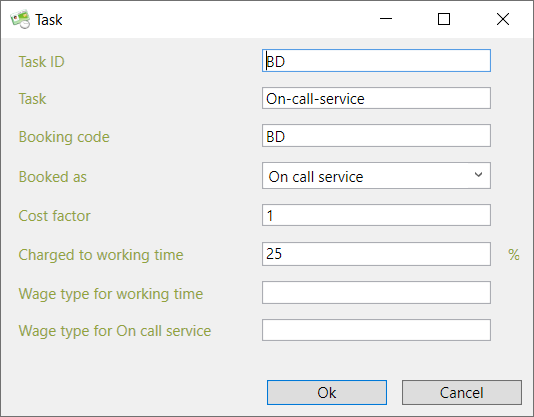

Define own wage types for each task

It is possible to overwrite the wage types entered in the TimePunch options for data export in the TimePunch activities.

To do this, a new task must be created in the project, or alternatively a new general task. Of course, the wage types can also be set subsequently for existing tasks.

The wage type is used when wage data is exported to DATEV and Lexware for the working time posted for it.

In the case of on-call time, you can also specify a separate wage type for posting on-call time.